Malaysia Personal Income Tax Guide 2017. Particular Benefit In Kind 71.

Spesifikasi Kaedah Pengiraan Berkomputer Pcb 2022 Lembaga Hasil Dalam Negeri Malaysia Amendment Studocu

32005 Original and Addendum and Public Ruling No.

. 32013 and Public Ruling No. Here cost means the actual cost incurred by the employer. CP8D INFORMATION LAYOUT - Pin.

Perks include gift vouchers company credit cards company insurance. A review on 3 types of allowances with reference from LHDN Tax Ruling including the newest listing of tax incentive tax deduction for company in Malaysia. Lembaga Hasil Dalam Negeri Malaysia.

There are 2 methods specified by LHDN to determine the value of BIKs. Which qualifies for the exemption. Superceded by the Public Ruling No.

According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year. Under this method each BIK provided to the employee is ascertained by using the formula below. This guide is for assessment year 2017Please visit our updated income tax guide for assessment year 2019.

Benefit In Kind is a non-cash allowance. By which we mean perquisites and benefits-in-kind. RM420080 and RM420010 is reported as 4200.

Motor cars provided by employers are taxable benefit in kind. And benefits used by the employee solely for performing employment duty2 Thus in this study three central questions have been raised with regards to benefits in kind and zakat in Malaysia. Where a motorcar is provided the benefit to be assessed is the.

Revisiting Scenario 1 where the benefits LHDN BIK Public Rulings 12122019 on the value of private use of the car and petrol provided is benefit-in-kind and taxable to Leong who is receiving the benefits as the car which is provided to the Leong is regarded to be used privately if. As the clock ticks for personal income tax deadline in Malaysia 2018 like gainfully employed Malaysians you may have started visiting the LHDN Malaysia website to do your E-Filing as both a proactive and precautionary measure. Motorcar and other related benefits 711.

K Value Of Living Accommodation Value of living accommodation benefit received by employee from employer. The most common type of Benefit In Kind are. Annual value of BIK Cost to the employer of the asset prescribed average lifespan of the asset.

J Benefits In Kind Value of benefits in kind received by employee from employer. This benefit is treated as income of the employees. Benefits In Kind Decimal 11 The total value of the benefits in kind provided by the employer excludes the value in sen.

On the other hand in terms of taxation practice all benefits in kind received by an employee are taxable by Inland Revenue Board of Malaysia. Also referred to as company or employee perks these items have cash value and are counted as part of your income. 13th April 2017 - 7 min read.

Should benefit in kind BIK be 2 Refers to paragraph 9 LHDN 2013 for list of benefits that are exempt from tax. The basis of computing the benefit whether the formula method or the prescribed value method must be consistently applied throughout the period of the provision of the benefit. Refer to Public Ruling No.

Superceded by Public Ruling No122017 29122017 - Refer Year 2017. 1112018 41740 PM. 112019 12122019 - Refer Year 2019.

Refer to Public Ruling No.

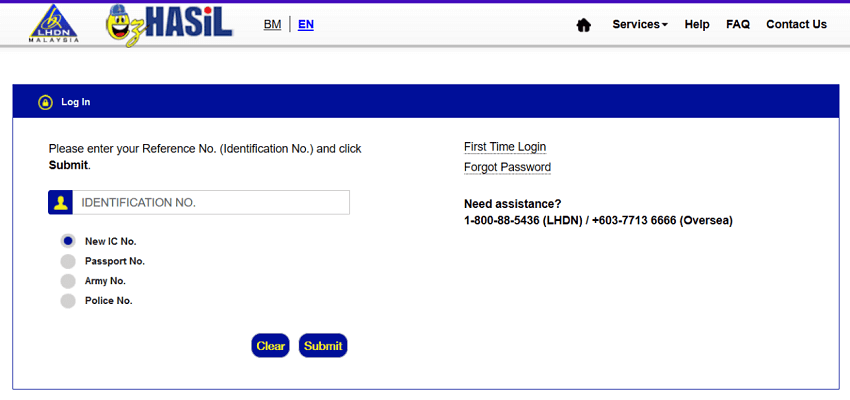

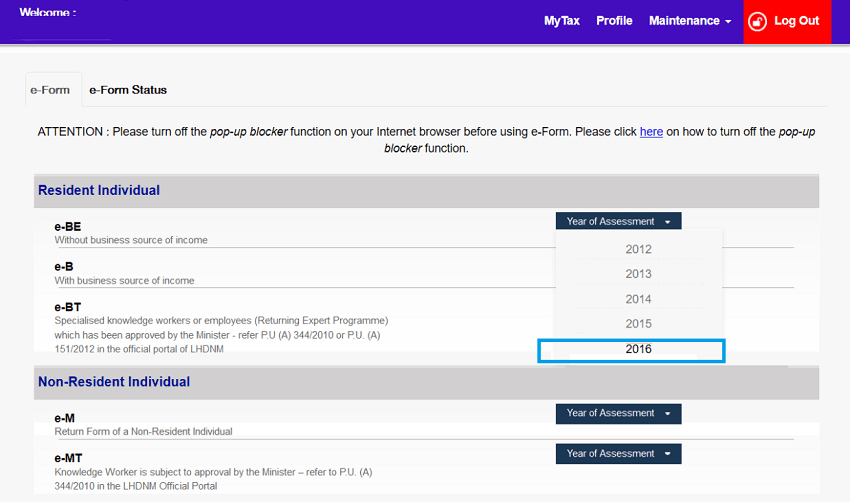

Ctos Lhdn E Filing Guide For Clueless Employees

Understanding Lhdn Form Ea Form E And Form Cp8d

Ctos Lhdn E Filing Guide For Clueless Employees

Ctos Lhdn E Filing Guide For Clueless Employees

Ctos Lhdn E Filing Guide For Clueless Employees

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

Malaysia Personal Income Tax Relief 2022

Ctos Lhdn E Filing Guide For Clueless Employees

Lhdn Irb Personal Income Tax Relief 2020

Ctos Lhdn E Filing Guide For Clueless Employees

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Malaysia Personal Income Tax Relief 2021